- Blog

- |Managing Payroll

- >Payroll

- >Payroll software

Do I need payroll software for my business?

As a payroll provider, we LOOOOVVVEEE payroll! However, we understand that not everyone is as passionate about it as we are.

For business owners, understanding exactly what is needed and how you could benefit isn't always very easy.

However, if you have been and are continuing to use outdated paper systems or time-consuming spreadsheets, then the chances are you look forward to payday about as much as a clip around the ear!

In this piece, we will take a look look at the sure-fire signs that indicate you need to change your payroll methods, and we'll analyse the benefits of using payroll software.

How do I know if I need payroll software?

You want an automated system that takes the strain off payday

You’d like flexibility tailored to your business

You want a solution that integrates with other business areas

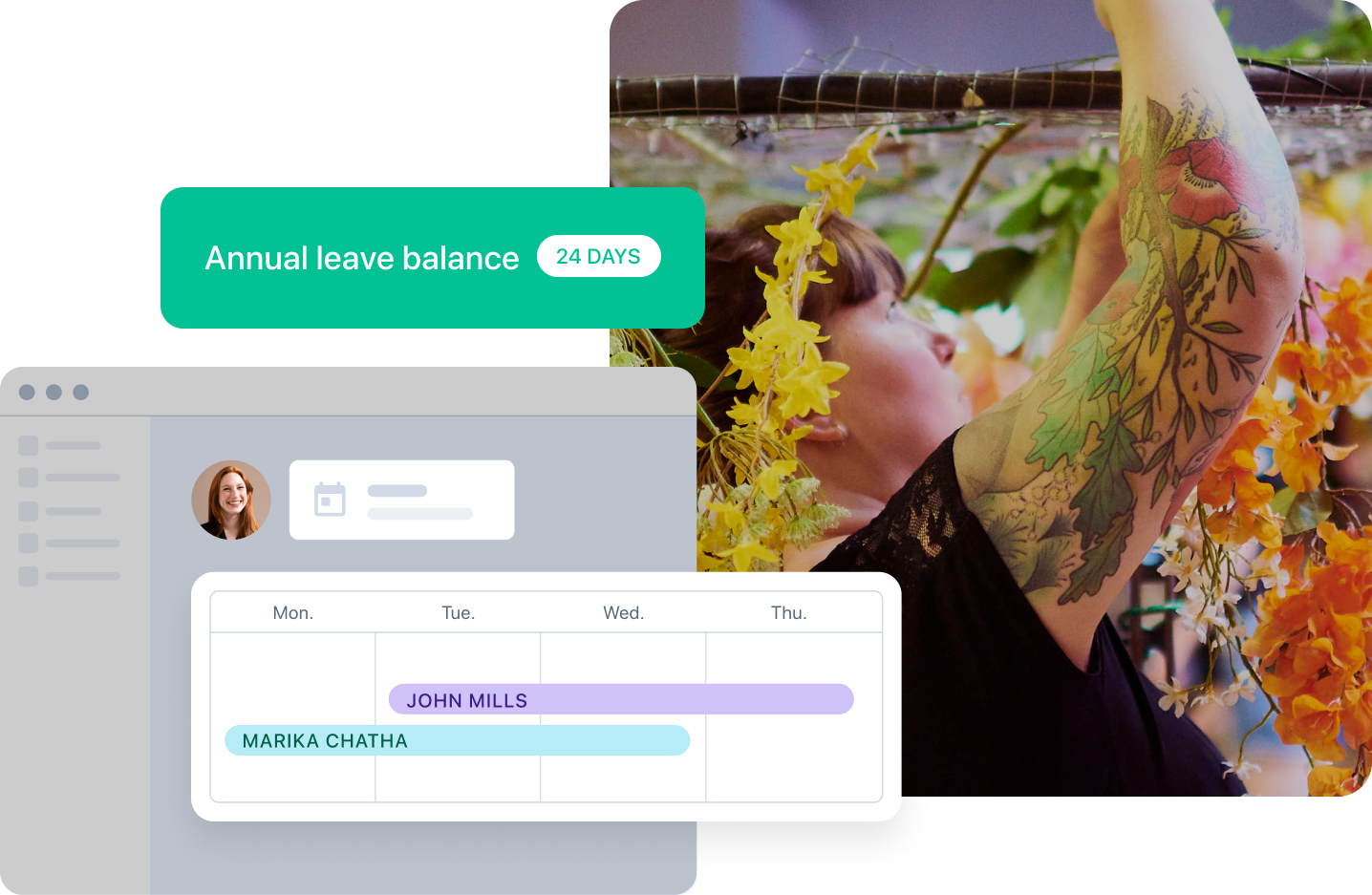

You’d like employees to be able to access their own pay information

You want to upgrade your systems and improve payroll accuracy

Reduced errors

Payroll mistakes have a habit of surfacing when you least expect them—sometimes years after the initial error has been made. Each time it happens, you run the risk of reducing staff morale, lowering productivity and, perhaps most importantly, damaging your reputation.

Thankfully though, there are payroll providers that can help you minimise errors and ensure that you meet your obligations as an employer.

If you make an error when running payroll, such as not sending your Full Payment Submission (FPS) on time or failing to send the correct number of FPSs, the penalty can be a hefty one. Depending on the number of staff you employ, it can range from anything between £100 to £400 per month.

More time and money

Payroll software saves you time and allows you to focus on other more high-value areas of your business, such as sales and customer service. It also saves money by automating day-to-day administrative tasks and minimising the likelihood of late filing and payment penalties.

So, how can payroll software contribute to increased efficiency and reduced costs?

By carrying out complex calculations and submitting accurate information to HMRC

Providing detailed management reports and insights within seconds

Paying wages directly into employees’ accounts, negating the need to manually write cheques

Reducing the need for storage along with the associated costs

Establishing a paper trail to quickly rectify errors

Keeping track of the number of hours worked for each employee

Automatically generates payslips

Increased growth potential

Being able to rely on a payroll solution geared to your business means you can focus on customer service, marketing, and growing your brand. If you’ve lost your zest for running the business, or can’t even remember why you started it in the first place, it could be due to the administrative burden that payroll presents.

With such complexities as auto enrolment, National Living and National Minimum Wage, and the regular threshold amendments, remaining up-to-date and compliant with complicated and changing legislation can be difficult.

Payroll software systems that update as legislation changes not only help you manage your legal obligations as an employer, but can also significantly improve your image for existing and prospective employees.

Could payroll software help your business?

With so many payroll solutions on the market, it can be difficult to cut through the gossip and find the best option.

Simplicity, flexibility, and reliability are all key when it comes to finding the right payroll software; but is there a solution that provides all of these in one user-friendly package?

Well, funnily enough, PayFit offers you all this and much, much more!

Seamless integration with HR management software allows you to deal with all aspects of being an employer in one easy package. You can automate all forms of staff leave, submit RTIs to HMRC with confidence, and prevent the mistakes that cost your business money.

Want to find out more about PayFit? Book a demo with one of our payroll experts!

HR In The Boardroom - The Business Benefits Of Strategic HR

PayFit Launches New Open API for Improved Integations

The Benefits Of Flexible Working For the UK Worforce

Leave & Absence Management Made Easier

Types Of Flexible Working - A Guide For Employers